Atlassian Interesting Key Facts

Mike Cannon Brookes and Scott Farquhar established Atlassian in 2002.

The two began the organization through bootstrapping and evidently held a Mastercard obligation of $10,000.

The name Atlassian came from Greek folklore’s Chart book, a titan rebuffed by the Greek divine beings to hold up the sky until the end of time.

The organization had put together their logo with respect to the titan as a x-formed human-like figure holding what seems, by all accounts, to be the lower part of the sky.

In September 2017, the organization rebranded and changed their logo, which has three distinct implications relying upon the looker’s viewpoint. It very well may be two hands doing a high five, a mountain that is fit to be scaled together, or the letter A being held by its two support points. These show cooperation which Atlassian exceptionally advances.

Atlassian delivered Jira in 2002, an issue and venture tracker.

Confluence. a group coordinated effort stage, was delivered in 2004

In 2012, Atlassian’s items were utilized by NASA’s Fly Impetus Research center where they fabricate programming utilized for demonstrating information sent from Mars meanderers and satellites as well as making arrangements for flight missions.

On December 10, 2015, Atlassian opened up to the world and was recorded in NASDAQ as Group.

In January 2017, Atlassian purchased Trello, one more administration stage, for $425 million.

In 2017, Atlassian sent off Step to contend with Slack. Soon thereafter, Slack purchased Step and HipChat from Atlassian.

Both Step and HipChat were shut in 2019.

On the fourth of September 2018, Atlassian obtained OpsGenie, an episode reaction and alarming apparatus.

83% of Fortune 500 organizations use Atlassian items.

Atlassian Company Overview

look at some intriguing data about Atlassian as a product and as an organization. Initially:Founders Mike Cannon Brookes, Scott Farquhar

Headquarters Sydney, New South Grains, Australia

Key people Shona Brown (Seat), Scott Farquhar (co-President), Mike Gun Brookes (co-Chief)

Products Jira Conversion, Hipchat/Step, Bitbucket/Bitbucket Server, Bamboo, Fisheye, Cauldron, Trello, Atlassian Commercial center, Sourcetree, Group, Statuspage, OpsGenie, Jira, Adjust, Halp, Mindville

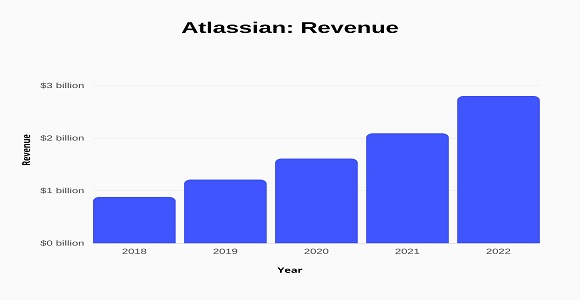

Revenue $2.80 billion (2022)

Working Income $106 million (2022)

Profit $614 million (2022)

Absolute Assets $3.36 billion (2022)

Absolute Equity $336 million (2022)

Number of employees 8,813 (June 2022)

Atlassian’s Revenue?

Atlassian shareholders

The value of Atlassian (TEAM) stock has been slashed in half this year as a result of the hawkish actions taken by central banks globally to keep inflation at bay.

Companies within the tech sector have seen their valuations plummet as investors perceive this industry as one that is highly susceptible to changes in the macroeconomic backdrop. However, Atlassian stock price has still pleased investors with hefty returns since the stock went public in 2015.

Who are the shareholders of Atlassian?

As indicated by structure 20-F, a recording expected for unfamiliar value backers by the US Protections and Trade Commission (SEC), by 30 June 2022, there were just two elements that held over 5% of Atlassian’s Group An offers.

These two organizations were T. Rowe Value Partners and Prudential Monetary. Most of the Class B shares gave by Atlassian are possessed by its two originators – 99.45%, as indicated by this documenting.

This gives Cannon Brookes and Farquhar command more than 87.92% of the organization’s all out casting a ballot power.

Information from Market Screener, starting around 2 November, recorded other institutional financial backers among the significant investors of Atlassian. These foundations were Sands Capital Administration, WCM Venture The executives and Craftsman Accomplices LP.

The two classes of Atlassian shares have casting a ballot rights, implying that all Atlassian investors have an idiom in the organization’s undertakings with respect to the quantity of offers they own. Notwithstanding, Class B shares have a democratic power that is multiple times higher than that of Class An offers.

Institutional Atlassian investors

T. Rowe Cost

T. Rowe Cost is a worldwide resource the executives firm regulating more than $1.2trn in resources, starting around 30 September 2022. This organization offers monetary guidance and venture items for clients in excess of 52 nations. A portion of the venture vehicles oversaw by T. Rowe Cost put resources into values from the whole way across the globe. This makes sense of why the firm is recorded as one of Atlassian greatest investors.

Sands Capital Administration

Sands Capital is a Virginia-based venture store that oversees more than $40bn in resources for its clients, starting around 30 September 2022. The organization offers different effectively overseen speculation portfolios with the objective to augment financial backers’ capital. These vehicles have some expertise in funding, development value, and public value. Atlassian stock could fall into the class of development value, making sense of why Sands Capital is one of Atlassian significant investors.

WCM Speculation The board

WCM is a California-based resource the executives firm that offers an adequate determination of value centered speculations that use various methodologies and systems to produce abundance for clients. A portion of the company’s portfolios put resources into unfamiliar stocks, and that could be the justification for why WCM is one of the biggest Group investors.

Craftsman Accomplices

Craftsman Accomplices is a speculation the executives firm that takes special care of modern financial backers, including high-total assets people and foundations. The firm had $120bn in resources under administration toward the finish of September 2022. A piece of these resources was put resources into worldwide values, for example, Group stock, making it among the biggest investors of Atlassian.

Jennison Partners

Jennison is an enlisted monetary consultant situated in New York that manages more than $171bn in resources for its clients, as at the hour of composing (2 November). The organization offers a few value centered venture vehicles that have practical experience in different portions of the monetary business sectors. Jennison has different portfolios including worldwide, global, little cap and mid-cap.

Atlassian significant investors among insiders

Starting around 30 June 2022, the organization recorded the accompanying five people as the top investors of Atlassian among insiders, in light of a sum of 144,891,749 remarkable Class An offers and 110,035,649 Class B shares.

Michael Gun Brookes – 54,717,824 Class B shares.

Scott Farquhar – 54,717,824 Class B shares.

Richard P. Wong – 146,966 Class An offers.

Enrique Salem – 131,563 Class An offers.

Steven Sordello – 45,990 Class An offers.

Altogether, insiders (barring the two pioneers) supposedly claimed 471,223 Class An offers, comparing to 0.43% of the complete number of portions of this class that were available for use starting around 30 June 2022.

Michael Gun Brookes

Michael Gun Brookes is the fellow benefactor and co-President of Atlassian. As per Forbes, he had a total assets of $12.2bn, starting around 1 November 2022 – fundamentally because of the enormous number of Atlassian Class B shares he possesses. He moved on from the College of New South Ridges and begun to work with his partner Farquhar on the product that is claimed by Atlassian today.

Scott Farquhar

Farquhar is the co-Chief and fellow benefactor of Atlassian close by Gun Brookes. He moved on from similar college as his accomplice, where he acquired two degrees. The objective of the organizers was to duplicate the beginning compensation that they would have acquired by joining any tech firm at the time by making their own endeavor. As per Forbes, Farquhar’s total assets was $12.1bn starting around 1 November 2022.

Richard P. Wong

Mr. Wong is an individual from the Governing body of Atlassian. He has been serving in this job starting around 2010. Wong is an accomplice at Accel and an individual from the Leading group of a few other tech firms, including UiPath and Instabug. Wong’s experience incorporates filling in as Head Advertising Official for Covad Correspondences and as brand supervisor for Procter and Bet (PG).

Last contemplations

Despite the fact that it very well might be helpful to realize who claims the most portions of Atlassian, this information ought not be utilized as a substitute for your own exploration. Continuously lead your own reasonable level of investment, checking out at the most recent stock news, an extensive variety of examiner critique, specialized and major examination.

Keep in mind, past execution doesn’t ensure future returns. Furthermore, never exchange with cash you can’t bear to lose